Mindfulness… and Money

By Stephen Edwards (’10), Baird Private Wealth Management in Winston-Salem, NC

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave.” – Morgan Housel, author of The Psychology of Money

Deacs, if you are reading this as a new grad of Mother So Dear, enormous congratulations are in order. You persevered through a pandemic and we are PROUD to call you a fellow alum!

What a wild year and half, huh? Yet here you are, seeking to make an impact amidst the loss, chaos and unrest throughout the world – living out the “Pro Humanitate” calling to use our knowledge, talents and compassion to better the lives of others. While our time on campus certainly prepared us in many ways from the classroom to the community into how we apply this calling to our work and the world, many times we feel less prepared in to how we apply our knowledge, talents and compassion to our own personal finances. As the Morgan Housel quote references above, our relationship with money is less about our intelligence and more about our behavior. How?

The competencies my friend Allison McWilliams laid out in her book, Five For Your First Five, are a wonderful guide for how you can OWN your career and life after college. A theme you will see throughout the 5 competencies as they relate to personal finance is mindfulness. Here they are:

Do The Work

Just as you would prepare for a new job, personal finances are no different. Ask yourself questions like “Where do you want to go?” and “Who do you want to be?” As you may have already gathered, you are in charge of your own finances and need to do your research as that owner. Investopedia is a good place to start for the basics, and then ask family, friends or professionals to give specific advice on personal finance strategy. More than anything, read and learn about basic financial concepts.

- Pro Tip: There are no bad questions! The main thing keeping us from asking is our own pride. Learn from those around you who have more experience and knowledge.

Build A Life and Create Community

It is important to name the roles you hold and those who rely on you financially. There may be some roles (like creating a budget or investing!) you really enjoy; and others you really dislike. Be mindful of your strengths and blind spots, and allocate your time with purpose. Money in and of itself holds no power, so do not let it control you. Be comfortable inviting others into your financial picture for advice and expertise. Do not live with a comparative financial mindset!

- Pro Tip: Do not be afraid to outsource. Whether with an advisor or accountant for financial planning or tax preparation, TIME IS MONEY.

Practice Reflection

Back to mindfulness – how often do you think about how you spend money? Those habits tell us a lot about ourselves… what we value, what we enjoy, and even what we fear. Reflect often, not just on your spending, but also on what you have learned both from your own research (do the work) and from others you trust and have learned from (build a life and create community). The best way to plan for the future is to be mindful of who we are and how we behaved in the past.

- Pro Tip: Watch your checking account’s balance over time. If you are paying all of your bills and it is going up or down, use the data it provides to take necessary action to cut spending or save!

Own What’s Next

This is where you piece it all together. You have done your research (what’s the difference in a Traditional IRA and a Roth IRA?), you have learned through community (get comfortable talking with friends and family members about money!), and you are more mindful about your finances than you were before (what did you do in March 2020? Did you freak out? Change strategies?). You cannot control the past, but you can make changes today. Make sure you have a budget or at least mindfulness around your spending. Make sure you are taking full advantage of your financial benefits through work (don’t leave a 401k match on the table!). Create an intentional plan for what is next for you and your loved ones, so that you hold the power over money, not the other way around. This will give you the greatest freedom to attack your goals and OWN your finances.

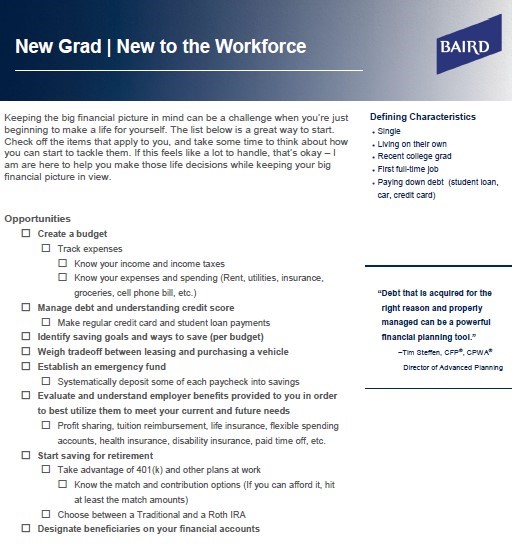

- Pro Tip: Have a checklist to get started… here is an example!